Banks and Money Exchange

|

Both foreigners and the citizens of Bulgaria can have a number of bank accounts in any currency. Foreign payments by enterprises and businessmen can be made by transfers. Foreign transfers within the current turnover [import of goods and services, transport, interest and capital rates, training, insurance, medical services and other transactions] have to be supported by documentation describing the necessity and target of the payment. Foreign transfers exceeding 25000 BGN have to be backed by documentation required by the National Bank of Bulgaria.

The System

The Central Bank

The bank system in Bulgaria is supervised by the National Bank of Bulgaria, which functions as a central bank. The NBB is an independent national institution, subordinate only to the National Assembly, which elects the President of the NBB and three vice-presidents on application of the President. The activity and tasks of the NBB are determined by the Act on the National Bank of Bulgaria, published in the National Paper no. 46 of 1997 with later changes. The National Bank of Bulgaria was founded in 1879. The maintenance of the stability of national currency, the Bulgarian lev, by implementation of certain policy of efficient payment system is its main target. After the introduction of the currency board system on July 1, 1997, the number of instruments of monetary policy at hand of the NBB has drastically decreased. The exchange rate is fixed by an act [1.95583 BGN = 1 EUR]. The National Bank of Bulgaria regulates and supervises the national bank system, to guarantee the stability of the system. The NBB issues licenses for banking activity, controls and gathers information from other banks. Other financial institutions are also a subject to licensing and control of the NBB. Moreover, the National Bank of Bulgaria controls transactions and settlements of other banks [national securities]. The NBB administers the Deposit of National Securities and controls the Central Deposit of Securities.

Commercial Banks.

There were 34 commercial banks in Bulgaria at the end of April 2006. 28 of them had international concessions. The remaining 6 were the departments of foreign banks. A list of banks operating in Bulgaria is included in attachment no. 13.

After the financial crisis in 1995 – 1997, when 17 institutions declared bankruptcy, the banking sector slowly regains its reputation. The safety of bank deposits is guaranteed by the Act on guarantee of bank deposits, published in the National Paper no. 49 of 1988, with later changes. Nowadays, in case of bank bankruptcy, the act guarantees full payment of deposits up to the amount of 10000 BGN to both private and legal persons.

The current financial situation of all banks is relatively stable. The indices of solvency and profitability have systematically improved. Modern financial instruments and the right standards of client service have been introduced with foreign investors.

At the end of February 2006, the general value of assets of the bank sector amounted to 32.7 billion BGN [16.7 billion EURO], i.e. a 30% rise in comparison to the same time the previous year. In 2004 – 2006 a rising tendency of the value and number of credits granted to enterprises has sustained.

In February 2006 the total value of credits granted to enterprises and people was18 billion BGN thus 28% higher in comparison with the same tame the previous year. It is worth mentioning that credits for individual people were characteristic of strongest growth dynamics [a 48% value increase between February 2005 and February 2006 reaching 6.5 billion BGN – 36% of total credits granted to enterprises and people]. A low level of interest rates, growing consumption and investment demand, the increasing trust in the bank sector contributed to the dynamic credit activity.

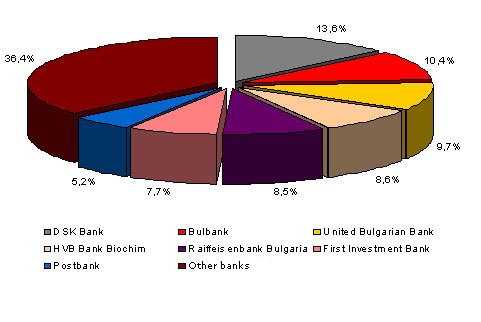

Fig. The Structure of Bank Sector acc. to Assets Value [at the end of 2005]

The modernization of bank infrastructure and introduction of new services and products is progressing fast, which is confirmed by a dynamic increase of non-cash transactions. According to the information of Borica Financial Institution [which services payments made by cash cards], there 13.900 electronic terminals and 2.300 ATMs at the end of 2005 [great progress in comparison with 2004 when there were 6800 terminals and 1800 ATMs]. An increase in the number of cash cards is also positive and clear. The process of privatization of the bank sector has been almost completed. The last large national bank, the DSK Bank, was privatized in 2004. Foreign capital is of great importance in the banking system. The banks with domination of foreign investors have about 85% participation in the general value of assets of the banking sector. A systematic development of credit offer is an important factor stimulating the development of the sector. The interest of denominated Euro credits is slightly lower in comparison with BGN or USD credits. It results from the introduced currency board mechanism [fixed value of lev]. For example, in March 2004 the average monthly interest of short-term Euro credits for enterprises was 6.99% [USD – 8.79%, BGN – 8.83%].

Tab. 2 Average monthly level of interest of BGN credit in commercial banks, December 2005 – March 2006

|

Short-term credits |

Long-term credits |

|||

|

|

Enterprises

|

House Holds* |

Enterprises

|

House Holds* |

|

Dec-05

|

8,41

|

12,62 / 10,75

|

9,78

|

10,55 / 6,88

|

|

Jan-06

|

8,91

|

12,94 / 11,00

|

9,94

|

11,04 / 6,70

|

|

Feb-06

|

8,69

|

12,36 / 12,68

|

9,58

|

10,69 / 7,07

|

|

Mar-06

|

8,83

|

12,24 / 13,74

|

9,19

|

10,37 / 6,68

|

Consumer credits/land credits

Source: The National Bank of Bulgaria

Source: The National Bank of Bulgaria